Today’s Autumn

Statement failed to live up to the rhetoric. There was little for those who

have suffered the most from austerity and nothing for our beleaguered public

services.

The main significance of the Autumn

Statement for Scotland is the impact on public spending. Under the new devolved

powers the Scottish Budget is made up of the Barnett formula, less the Block

Grant Adjustment, plus devolved tax changes agreed by the Scottish

Government. This means the Barnett

formula remains an important component of the Scottish budget and is based on a

proportion of English spending on devolved services, like health and local

government.

The Barnett consequentials of today's Autumn

Statement are an additional £800m for Scotland. Sadly, this is less

attractive than it sounds because it refers to capital spending. While capital

spending is welcome, including the City Deals, we have to recognise the

significant leakages it has from the Scottish economy. In contrast, revenue

spending is much more likely to be spent on the high street.

The departmental revenue spending

plans remain the same, which means we are still facing substantial cuts to

services over the next three years - up to £1.5bn, most of which the Scottish

Government is likely to pass on to local government. There was no hoped for

increase in English NHS or social care spending, which would have had positive

Barnett consequentials.

This all means a tricky Scottish

budget for Derek Mackay MSP when he sets out the Scottish Government's spending

plans on 15 December.

Other announcements today that impact

on Scotland include an increase in the so called National 'Living Wage' from

£7.20 an hour to £7.50 from April next year. This only applies to those over 25

years of age and is not to be confused with the real Scottish Living Wage,

calculated based on what people need to live, which has recently been increased

to £8.45.

There is an increase in the lower

income tax threshold to £11,500 that benefits higher income taxpayers as much as the low paid. The same applies to the higher rate tax thresholds and the previously announced cut in Corporation Tax. As IPPR argues, this tax cut for the top is the wrong priority.

There is also some modest relief for

low paid members who will transfer to the new Universal Credit benefit, because

the taper rate is to be cut

from 65% to 63% from April next year.

The economic forecasts in the

statement are generally gloomy. Growth forecasts are down, debt and borrowing

will rise, in a large part due to Brexit. There has been a relaxation from Osborne's unachievable targets, but as the OBR says, it isn't going to be easy to balance the books in the next parliament either. Ageing along could add 0.8% of GDP by 2025/6. All of this shows that austerity has

failed dismally, yet the UK government ploughs on regardless.

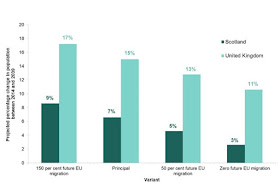

The OBR has identified delayed investment since Brexit along with inflation as the big driver of lower growth, only partly offset by export opportunities from the lower pound. In a separate announcement today, the ONS released their post-Brexit population forecasts for Scotland. This chart shows how population growth will be much slower in Scotland and that has economic consequences as well.

The more informative OBR forecasts

offer little cheer. Wages will be £1000 lower in 2020 than the government

predicted in April.

Overall, as Jeremy Corbyn puts it, "This is what happens when government and the economic model it's relied on for a generation fails to deliver".

No comments:

Post a Comment