Pensions are meant to safeguard our future, but that future is threatened by the burning of carbon in fossil fuels like coal, oil and gas. It's also a poor investment, which is why there is a growing movement to divest our pensions from fossil fuel investments.

I was in London yesterday for our UK annual pensions conference, which included the launch of UNISON’s new guide on this issue. It is designed to help members of local government pension schemes push for changes in the investment of their funds. The aim is to explore alternative investment opportunities, allowing funds to sell their shares and bonds in fossil fuels and to go carbon-free.

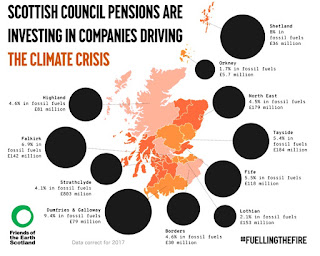

This is an issue that UNISON Scotland has championed for several years with our ReIvest campaign partners, FoE and Common Weal. Scottish Local Government Pension Scheme funds have some £1.8bn invested in fossil fuel companies - that figure grows to £16bn across the UK.

New government regulations for fossil fuels have raised the costs of high-polluting industries and reduced their investment appeal. Equally, emerging clean and green technology has created new and lucrative business opportunities for funds. The UK government is also consulting on allowing pension schemes to dump fossil fuel investments by dropping ‘best returns’ legal rules.

In Scotland, all local authorities, including those who administer the local SLGPS funds, have a statutory duty to reduce emissions in accordance with the Climate Change (Scotland) Act. That is an additional reason for challenging investment proposals to invest in fossil fuels.

One of the strengths of this new guide is to challenge the conventional wisdom that fiduciary duty is a barrier to divestment. The law is actually quite clear, pension funds should consider any factors that have a financial impact on the performance of their investments, including social, environmental and corporate governance factors. Trustees can take account of non- financial factors where they have good reason to think that scheme members share their view, and there is no risk of major financial harm to the fund.

The guide also sets out a range of actions anyone who is concerned about this issue can take - not just our union branches and members.

By investing in fossil fuel extraction, our local councils are attempting to take a short term profit from climate change. As public bodies, councils have a responsibility to work for the public good, they shouldn’t be financially and politically supporting the most destructive industry on the planet. Fossil fuel investments undermine existing Scottish and local authority climate change mitigation and adaptation strategies.

Let's protect our hard earned pensions and leave a planet fit for future generations.

No comments:

Post a Comment